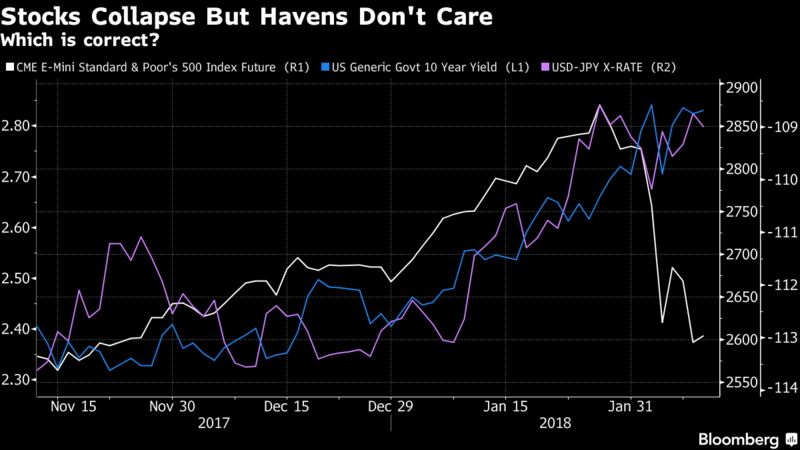

So much for the adage that stocks are inversely correlated with Treasuries and the Japanese yen. Equities have slumped over the past two weeks but there’s been little reaction in the classic haven assets.

One positive way to skew this information is that other assets are confirming the consensus view that this is just a “healthy correction” in the equity market and the good times will roll on again very soon.

The negative interpretation is that there’s far too much complacency, and so broader market pain will ensue if shares don’t bounce back imminently.

Some might argue that assets are no longer moving in line — but anyone who holds that view may want to have a look at what happened in 2008 when emerging markets supposedly decoupled from their developed counterparts. That seemed true to some until the real pain hit, and then it was quite clearly shown up to be pretty ridiculous.

Global economies and asset markets are more connected today than ever before.While stocks from Sydney to Hong Kong are selling off Friday, gold has barely budged and the yen is actually weaker. Treasuries, too, have moved relatively little over the past 24 hours.

Source:Bloomberg

You may also like

-

Xiaomi Makes Its Trading Debut on the Defensive

-

U.S. Pulls Trigger on China Tariffs, Sparking Vow of Retaliation

-

China Vows Not to Fire Tariff Shot Ahead of U.S. in Trade War

-

Najib Pleads Not Guilty to Corruption Charges in 1MDB Case By

-

China Think Tank Warns of Potential ‘Financial Panic’ in Leaked Note