U.S. stocks tumbled, pushing benchmark gauges back toward the lows set during the worst of the February rout, as President Donald Trump’s decision to slap tariffs on Chinese goods heightened concern that a trade war could throttle global growth.

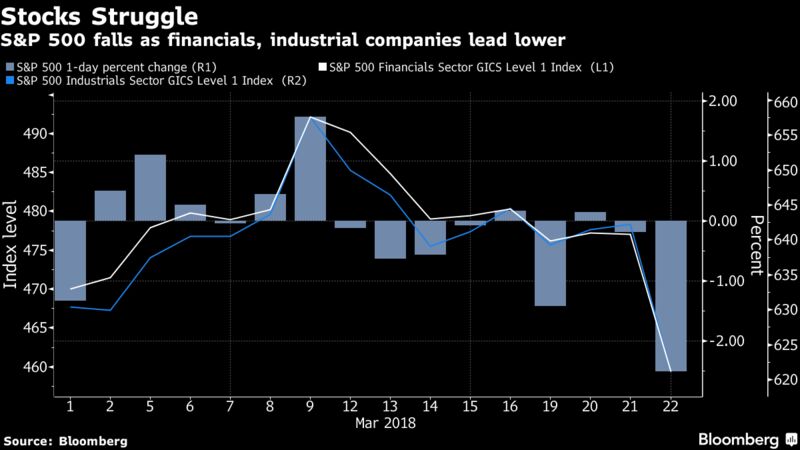

The S&P 500 Index sank 2.5 percent, the biggest one-day drop in six weeks, and the Dow Jones Industrial Average lost more than 700 points. As investors dumped stocks, they rushed to the safety of the Treasury bond market, where yields fell back toward 2.8 percent, and the yen, which rallied the most in three weeks.

In a stock market that’s been floundering ever since it hit record highs in late January, the prospect of a widening trade spat only added to jitters. Traders had already been bracing for the possibility of slowing growth as the Federal Reserve reiterated its commitment to further interest-rate increases after Wednesday’s hike. Not even technology stocks, long the favorite of Wall Street investors, have provided relief of late as the latest data fiasco at Facebook sparked a rout in the sector this week. The Nasdaq is down more than 6 percent since its record 10 days ago.

“Tariffs mean a trade war and the news has the world’s investors running for the exits,” Chris Rupkey, chief financial economist at MUFG Union Bank. “Those are storm clouds out there, that’s what the stock market is saying and that’s why investors are running for the exits.”

Trump’s first trade action directly aimed at China comes as policy makers including IMF Managing Director Christine Lagarde warn of a global trade conflict that could undermine the broadest world recovery in years. Stocks were also hit earlier when John Dowd resigned as Trump’s lead attorney countering Special Counsel Robert Mueller’s Russia probe as the inquiry into possible collusion in the 2016 election intensifies.

“The market doesn’t like trade wars, the market doesn’t like that the Fed is adamant about raising rates,” said Matt Schreiber, president and chief investment strategist at WBI Investments in Red Bank, New Jersey.

The technology rout also picked up steam, in large part because the sector stands to lose if China retaliates as it said it will. There was more, though. Facebook renewed its slide as the controversy over its handling of user data prompted calls for the Chief Executive Mark Zuckerberg to appear before lawmakers. The Fed’s decision on Wednesday to raise rates and possibly accelerate the pace of tightening also has investors on edge.

Elsewhere, West Texas oil fluctuated before falling and the Australian dollar slipped after the country’s unemployment rate climbed. The British pound initially jumped after the country’s central bank voted 7-2 to maintain interest rates, but pared as investors digested comments from policy makers that weren’t overtly hawkish.

Source:BLOOMBERG

You may also like

-

Xiaomi Makes Its Trading Debut on the Defensive

-

U.S. Pulls Trigger on China Tariffs, Sparking Vow of Retaliation

-

China Vows Not to Fire Tariff Shot Ahead of U.S. in Trade War

-

Najib Pleads Not Guilty to Corruption Charges in 1MDB Case By

-

China Think Tank Warns of Potential ‘Financial Panic’ in Leaked Note