The moves in stocks lately are just strange — but there’s still a logical approach to investing for the expected end of “easy money,” according to JPMorgan Chase & C0.

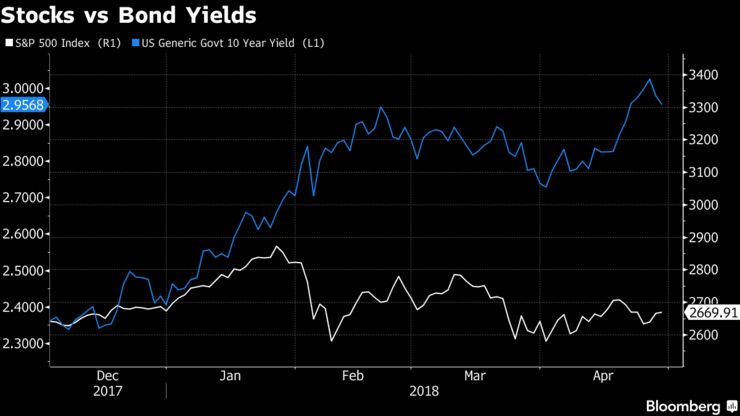

While markets and the strategists who follow them are struggling to figure out the impact of rising U.S. interest rates, the sideways path of equities — given above-consensus earnings — is a notable outlier among asset-class movements, the firm wrote in a note Friday.

“Equities’ tepid response to strong earnings is worrisome,” said the JPMorgan strategists, led by John Normand, head of cross-asset fundamental strategy. “As cash rate expectations rise to levels acknowledging restrictive policy by late 2019/2020, should equities now price the end of easy money? Such an early peak would have no precedent, so requires a shock.”

Here’s the sequence of late-cycle trades JPMorgan recommends:

- Late 2017 through 2018: Short duration, long breakevens and long oil while Fed policy is still accommodative

- 2018: Underweight credit versus equities to reduce beta to a very old business cycle

- 2018: A pairwise approach to FX rather than a blanket USD view

- 2019: Underweight equities, long duration, long gold and long the yen as Fed policy slows the economy and real rates collapse

The bank said that only one of the 10 largest bond sell-offs in the past 15 years has been associated with stock market weakness. And while they pin some of the reason for the February tumble in equities on higher Treasury yields, the strategists said that “this month, U.S. rates have risen only half as much as they did earlier this year, but stocks are still sidewinding despite bumper earnings.”

JPMorgan’s comments came as Goldman Sachs Group Inc. weighed in to say the Federal Reserve may not even be close to the halfway mark in its tightening cycle, from a perspective that looks at the overall goal of slowing growth to a sustainable pace without tipping the economy into recession.

“Only around a quarter of the required slowdown to a trend pace has occurred, and we don’t expect that picture to change quickly,” Goldman strategists, led by chief economist Jan Hatzius, wrote in a note dated Saturday. “Partly reflecting this, we view the risks to our forecast of a terminal rate of 3 1/4 percent to 3 1/2 percent as tilted to the upside.”

JPMorgan’s Normand and his fellow strategists note that two-year rates, which have “the most momentum,” may be drawing some focus because markets are within 25 basis points of pricing the Fed’s cash-rate projection for the end of 2019, 2.9 percent. “That level is significant because it would mark the end of accommodation, after which usually comes restrictive policy,” they said.

But they caution against worrying too much about Treasury yield levels.“The persistent fixation on yield curve flattening and a 3 percent U.S. 10-year is not one we share,” they said in the note. “The curve’s shape is less important for financial conditions than the real Fed funds rate, which at near 0% remains accommodative. A nominal U.S 10-year of 3 percent, which is only 0.8 percent in real terms, seems about 75 basis points away from challenging equities based on the earnings yield/real bond yield framework used by some asset allocators.”

The strategists say they’ve been comfortable underweighting credit versus equities pre-emptively in multi-asset portfolios, though they called credit metrics more mixed than deteriorating. They noted that credit spreads tend to bottom out well before equities reach a top.“A peak in equities this soon in the late cycle has no precedent,” the strategists wrote. “Peak margins mean less equity outperformance, not losses.”

They added that “2019 could be the true late-cycle year when almost every asset underperforms cash. But that scenario is too medium-term to price in now such that equities never reclaim or surpass their February highs.”

Source:BLOOMBERG