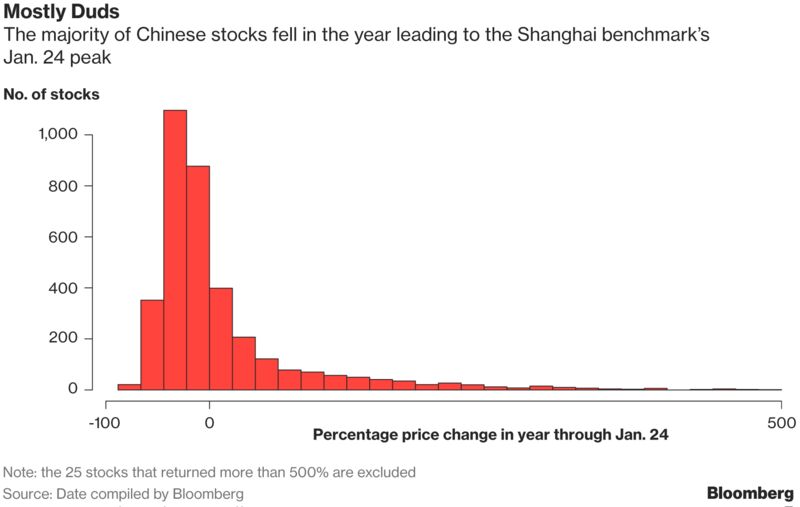

China’s stock market wasn’t in great shape even before the past month’s slide.

The rally leading into it was driven by a few dominant industry players, favored by investors concerned that smaller companies would be squeezed by higher funding costs and a slowing economy. In the 12 months through Jan. 24, when the Shanghai index peaked, only a third of onshore Chinese stocks rose. Excluding those that listed in 2017 and this year, four out of five dropped.

The lack of breadth meant that when sentiment turned, the market’s source of upward momentum disappeared as everyone rushed to exit the same stocks at once. After climbing 13 percent over the preceding year, the Shanghai Composite Index plunged 12 percent in a little over two weeks.

“Investors’ strategies have turned the market into an ETF,” said Wu Yuefeng, a Beijing-based fund manager at Fundin Capital Management Co., which oversees about 2 billion yuan ($315 million). “If this continues on a large scale, it wouldn’t be surprising to see sharp gains followed by sharp declines.”

The structural imbalance is unlikely to change for now, suggesting more volatility ahead for the already notoriously wild Chinese stock market. When mainland markets reopened Thursday after the week-long Lunar New Year holiday, consumer giants including Kweichow Moutai Co. outperformed in Shanghai. In the 12 months through Jan. 24, Moutai’s share price more than doubled. In the next two weeks, it tumbled 11 percent.

Blue Chips Favored

Slowing economic growth and tighter liquidity tend to benefit Chinese companies that are dominant in their industries. The earnings growth of small caps has cooled and the effects of the 2015 boom and bust linger: even after two straight years of declines, the ChiNext gauge of venture enterprises is more than twice as pricey as the large-cap CSI 300 Index.

The low volatility of large caps also prompted some investors to add leverage to boost returns, exacerbating their declines during the selloff, according to Hao Hong, chief strategist at Bocom International Holdings Co. in Hong Kong. Before the rout, the outstanding margin balance had reached the highest since early 2016.

“The positioning is very extreme,” he said. “Stability has made them a good target for leverage. Leverage has made them vulnerable.”

Hong said small caps will catch up this year as regulators seek to spread gains across the market and the so-called National Team pares positions in large caps. The CSI 300’s level relative to ChiNext has slipped since the selloff began, though it remains near the highest since 2013.

Fundin’s Wu said it will take a while for small caps to become attractive to investors again and it will be harder to find good picks this year. In his view, large caps are still the way to go for now.

“Gains in the index may be less pronounced this year,” he said. “As small caps’ valuations become more reasonable and earnings improve, they’ll be noticed by investors again. After their risks are cleared, the market will be healthier and the foundation of a bull market stronger.”

SOURCE:BLOOMBERG

You may also like

-

Xiaomi Makes Its Trading Debut on the Defensive

-

U.S. Pulls Trigger on China Tariffs, Sparking Vow of Retaliation

-

China Vows Not to Fire Tariff Shot Ahead of U.S. in Trade War

-

Najib Pleads Not Guilty to Corruption Charges in 1MDB Case By

-

China Think Tank Warns of Potential ‘Financial Panic’ in Leaked Note