The clock is ticking for bond traders still looking to scoop up cheap bets on a more hawkish Federal Reserve.

Subtle tweaks in the language of this week’s Fed policy statement may be fueling the wagers, according to Goldman Sachs Group Inc. Chief Economist Jan Hatzius.

“While further rate increases were already implied by the previous wording – and by the hikes projected in the December summary of economic projections – we think the committee implemented this change to emphasize the durability of the hiking cycle they foresee,” Hatzius wrote in a Wednesday note to clients.

Other strategists are now warning of an upward revision to the Fed’s longer-term rate projections next month.

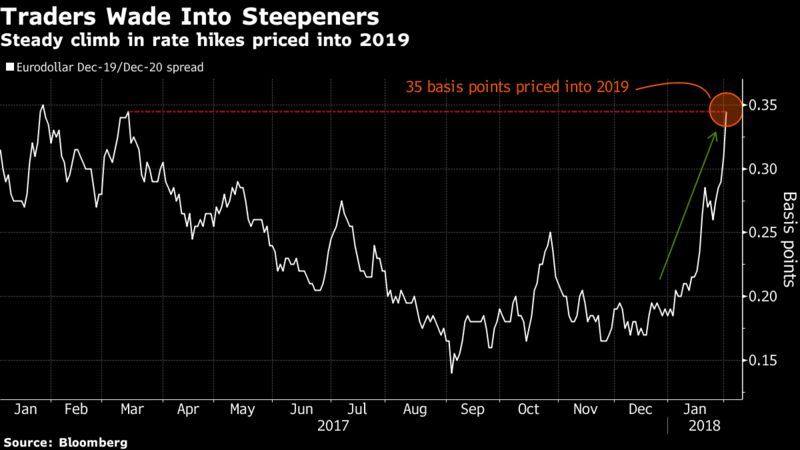

The steepening move in the eurodollar market is matched by a 21 percent climb in open interest in December-18 futures and 37 percent rise in December-19 futures since the start of the year. Thursday saw volume on spread trades between the two surge to the second-highest on record. In the options space, new hawkish bets are being lined up for 2019, while existing downside hedges are increasingly being pushed further out the eurodollar strip.Traders are wagering the strip will continue its post-FOMC bear steepening, with the red (2019), green (2020) and blue (2021) packs significantly underperforming the front-end white packs.

By Edward Bolingbroke , source and extract from Bloomberg