Chinese President Xi Jinping has an ambitious master plan for his country’s transformation into a wealthy, technology-driven global economic power. And U.S. companies need not apply.

That’s why the current trade rumble between the U.S. and China, in which the Trump administration is threatening to slap tariffs on $34 billion of Chinese imports and Beijing promises to respond in kind, is far more than just a spat over market restrictions, intellectual property rights and the epic U.S. deficit.

On a deeper level, the standoff reflects an escalating economic and military rivalry between a status quo power and one of the most remarkable growth miracles in history. It’s a clash between two divergent systems, (one state-directed, the other market-driven) with markedly divergent world views and national aspirations. That strategic tension seems likely to intensify, regardless of how the current brinkmanship over tariffs plays out.

It’s also a battle for global influence. Whereas the U.S. has long sought to spread democracy and free markets to other nations, China’s ruling Communist Party is just starting to pitch its heavy-handed growth model as an alternative for developing nations. And Xi is backing it up with hundreds of billions of dollars in loans for infrastructure projects from Asia to Europe and beyond.

In the U.S., a bipartisan consensus has begun to emerge that now is the time to stand up to China, even if many oppose President Donald Trump’s tactics. Senate Minority Leader Chuck Schumer, a Democrat, has attacked Trump for not being tougher on China, saying last week that failure to change Beijing’s behavior now could hurt the U.S. economy “for generations to come.”

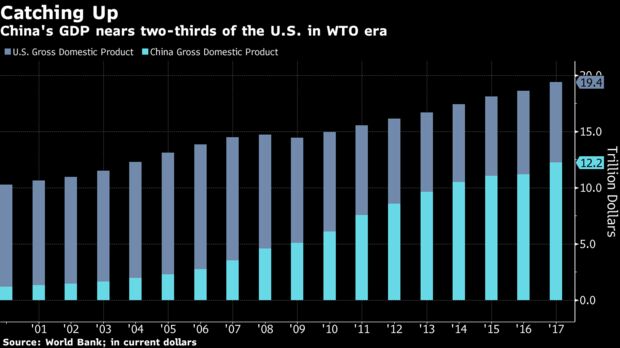

With a roughly $13 trillion economy and expanding wealth, China is now going head-to-head with the U.S. in advanced manufacturing and digital technologies. It also has the wherewithal to make rapid technological progress in defense, particularly with air-to-air missile systems that pose a strategic challenge in Asia for the U.S. and its allies.

Xi is playing a long game, pursuing what he calls the “Chinese Dream,” or “the great rejuvenation of the Chinese nation.” To get there, he has set targets to double his country’s per capita gross domestic product (from 2010 levels) to $10,000 by 2021 and refashion China into a tech powerhouse, competitive in robotics, new energy-vehicles, chips, software and other bleeding-edge industries under his Made in China 2025 program. A separate development strategy envisions China ruling in artificial intelligence by 2030.

The aim is to produce global champions — not just national ones — and Xi’s government is ready to use the commanding heights of its one-party state to steer subsidies and use preferential policies and ambitious local content rules favoring Chinese companies to get there. At stake are industries that make up about 40 percent of China’s value-added industrial manufacturing sector, according to an analysis by the U.S. Chamber of Commerce, citing data by the Rhodium Group, a research firm.

The Trump administration views such deficits as alarming and Chinese trade practices as brash mercantilism, even a national security threat. U.S. Defense Secretary Jim Mattis labeled China a “strategic competitor using predatory economics” in January as he unveiled the Pentagon’s National Defense Strategy.

Xi views his economy’s shift into higher-tech manufacturing not only as a crucial part of its development, what with surging labor costs, a rapidly aging population and high corporate debt levels — but also as a fulfillment of China’s destiny. That process is well underway: China is set to overtake the entire euro area this year, according to data compiled by Bloomberg.

Talks to avoid a trade war have stalled in part over U.S. demands that China reduce state support for high-tech industries. While China has signaled a willingness to buy more American goods to balance out the deficit, it has refused to trade away what it views as an essential part of its economic future.

Tech companies are on the front lines of this contest for global supremacy. Back in 2013, Chinese investigators started making life difficult for American tech “guardian warriors” like Google, Intel Corp., Apple Inc. and Microsoft Corp. after a magazine with ties to the Communist Party sounded the alarm about their dominant role in Chinese networks and business.

The U.S. has been just as inhospitable to Chinese tech concerns, with telecommunication makers like Huawei Technologies Co., ZTE Corp. and China Mobile Ltd. being viewed as national security risks. The Trump administration has also weighed restrictions on Chinese companies and start-ups in sectors ranging from aerospace to robotics.

This week’s tariffs, however, may show which side has the stronger hand. The first batch will take force Friday barring any last-minute deal. Trump has threatened duties on another $200 billion worth of Chinese goods if Beijing imposes countermeasures.

Xi is betting that Trump will back down as price increases in politically sensitive states make him worry about losing the next election in 2020. Xi enjoys something closer to life-time job security, thanks to the repeal of Chinese presidential term limits in February.

The sharp downturn in Chinese stock markets amid rising trade tensions is scarcely a threat to his rule. His party-led government has a big say over strategy and investments plans at giant state-owned enterprises, which control 40 percent of China’s industrial assets and some of the world’s biggest banks.

Still, anti-trade rhetoric underpinned Trump’s election win, and if anything the former New York real estate developer has doubled down on using tariffs in spats with both foes and allies. Although polls suggest Trump faces difficult mid-term elections in November, a fight to replace a U.S. Supreme Court justice may prompt his political base to overlook slightly higher monthly bills.

Economists and trade experts who testified in June before the U.S.-China Economic and Security Review Commission, set up by Congress to track the national security implications of trade with China, say tariffs are likely to inflict a lot of economic damage on both economies and depress global trade.

Great Unwinding

China will also return the favor — Beijing has announced plans to target U.S. auto, aircraft, plastics and chemicals sectors — and “the imposition of tariffs will not solve the underlying Chinese distortive behavior,” warned Linda Menghetti Dempsey, vice president of International Economic Affairs at the National Association of Manufacturers.

Instead of using tariffs, the U.S. could’ve sought to join with the European Union and Japan to bring a case against China at the World Trade Organization. But that’s unlikely after Trump slapped tariffs on EU nations and Japan, while also undermining the WTO. His withdrawal from the 11-nation Trans-Pacific Partnership trade deal removed another key device to alter China’s behavior.

Some prominent academics are calling for more drastic measures to undercut China’s practice of trading market access for technology transfers, such as unwinding Asian supply networks in high-end tech sectors.

Just Beginning

Harvard Business School Professor Willy C. Shih favors tax incentives, and even setting up import processing zones in the U.S. to repatriate offshore suppliers for the likes of Intel, Apple and Microsoft. “It would strengthen our ability to sustain the most advanced semiconductor fabs in the United Sates,” Shih said.

In the end, the U.S. and China economic rivalry probably won’t be decided by administrative law judges or trade negotiators, but in the global marketplace. Right now, the U.S. still enjoys a lead in many tech and manufacturing sectors, particularly aerospace and biotech.

Yet the days when China could be dismissed as merely a low-wage assembly center for Western manufacturers are long gone. This is a country on what it views as a historic mission to become a 21st century economic power, and the contest is just beginning.

Source:Bloomberg

You may also like

-

Here’s How a Trade War Between the U.S. and China Could Get Ugly

-

Want to Win the Trade War? Long the Dollar

-

Volatile Yuan Puts Spotlight on China’s Capital-Control Buffers

-

Trump Decides Against Harshest Measures on China Investments

-

Goldman Sachs still sees oil rallying over $80 despite market concerns over key OPEC meeting