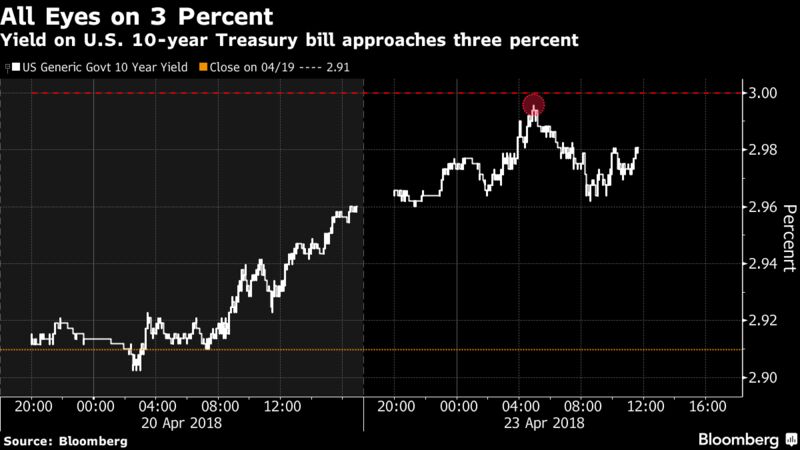

Ten-year Treasury yields sit closer to 3 percent than at any time in the past four years, prompting investors to dust off their playbooks for how to trade in an era of relatively higher rates.

Rising rates isn’t exactly a new problem for markets — the 10-year yield jumped 30 basis points in January alone — but this time the spike’s driven by surging commodity prices, not heady economic gains. And that’s thrown a wrinkle into the discussion, particularly when it comes to equities.

“Historically, the stock market has done OK with rising inflation, provided economic momentum was also rising,” Jim Paulsen, chief investment strategist at Leuthold Group, wrote in a note to clients Monday. “Stocks also have performed well even when economic momentum has faded, if inflation also moderates. However, periods of stagflation have produced poor results in both the stock and bond markets.”

Here’s how some markets may react to the rise in rates:

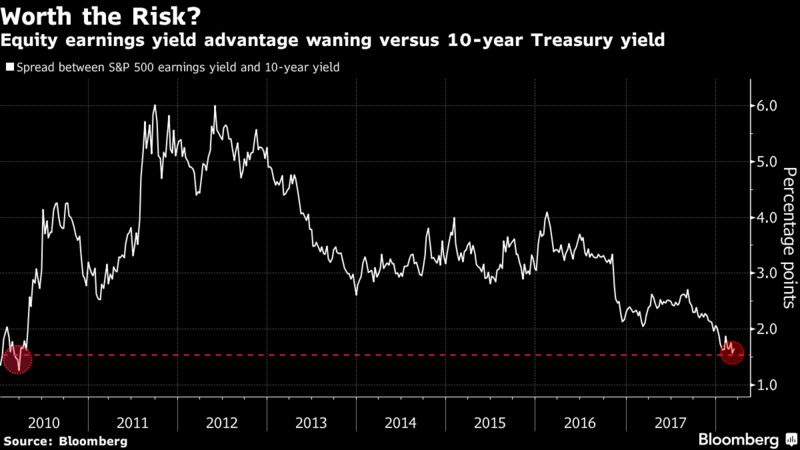

Since the financial crisis, stocks have paid out more than fixed income, but the premium is waning: The spread between the S&P 500’s earnings yield and that of the 10-year Treasury bill is hovering near the lowest levels in eight years.

If yields push past 3 percent, that could alter the value proposition for equities versus fixed income for years to come, according to Chris Verrone, the head of technical analysis at Strategas Research Partners.

“This is a 35-year trend change in bonds, we think it’s just begun,” he said in an interview on Bloomberg Television Monday. “We would encourage investors to consider that 1950 period, the last time bond yields went up. It took a while to go from 2 to 5 percent, but the trend was up and you stopped making money on the long side of the bond trade. That’s where we think we are right now.”

Emerging market investors are taking note, too. Unlike three months ago, when the spike in rates came left them sanguine, there’s more reason for worry now, from trade spats to signs synchronized global growth is slowing. Commodity-driven inflation could also lead to a faster pace of monetary tightening which would disproportionately harm emerging markets, according to Per Hammarlund, chief emerging-markets strategist at SEB in Stockholm.

Corporate Credit

The least creditworthy companies have benefited from low benchmark yields, but if easy money disappears and borrowing costs rise, servicing debt would become more expensive. For now, corporate credit is hanging in, with high yield spreads remaining off the tightest level since before the financial crisis.

“The question of course is how long can this last,” said Peter Boockvar, chief investment officer of Bleakley Financial Group, noting that current debt levels for S&P 500 companies outside of banks are at extremely high levels. “Stating the obvious, high debt levels along with higher interest rates is not the best combination.”

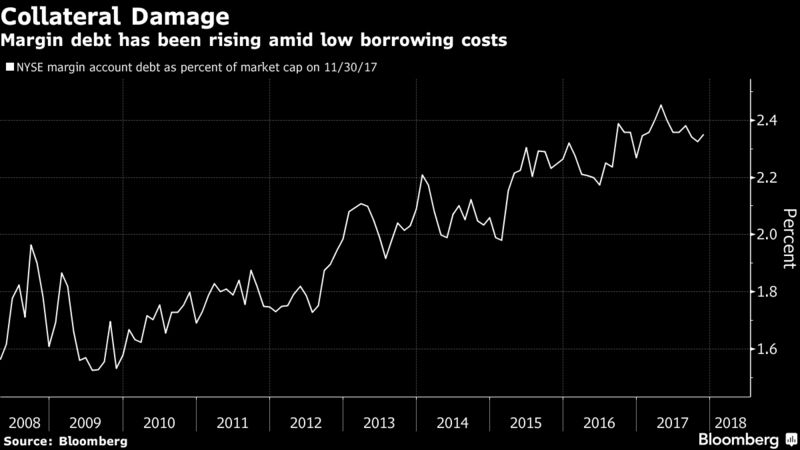

Matt Maley, an equity strategist at Miller Tabak & Co., also says staggering levels of investor leverage pose a risk. As rate rise, lenders increase costs on margin accounts which in turn prompt a gradual unwind of leverage that’s become too expensive, he said.

“When everyone has been talking about whether higher rates impact the economy, the more important thing is how it will impact leverage,” Maley said by phone. “It creates a headwind for the market.

Debt in New York Stock Exchange margin accounts is the highest on record, yet the measure necessarily rises when the value of stocks — which are used as underlying collateral — rises. And it looks relatively small: Margin debt is less than 3 percent of the total NYSE market capitalization. For that reason, leverage levels can’t be used as a timing tool for downturns, but rather pressures markets during periods where investors need to unwind, Maley said.

U.S. Dollar

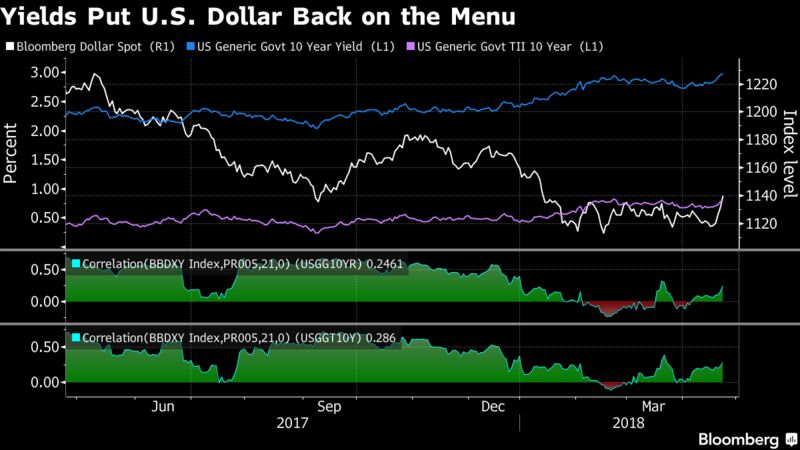

As for the U.S. dollar, higher yields — particularly real U.S. borrowing costs — have slowly lured investors back to the greenback. The Bloomberg Dollar Spot Index is in the midst of its best four-session stretch since the 2016 U.S. election, and has seen its one-month correlations with both 10-year Treasury yields and inflation-protected peers trend higher.

Neil Dutta, head of U.S. economics at Renaissance Macro Research LLC, attributes the pick-up in the dollar and real yields to the U.S. economy’s brighter outlook compared to the rest of the world. The continuation of this dynamic would paint a mixed, but positive, picture for risk assets.

“Our sense is that in coming quarters we see the dollar strengthen against most of the majors and for U.S. real rates to continue rising,” he writes. “Stocks should like the stronger growth environment, but dollar strength and higher real yields imply tighter financial conditions, providing some offset.”

Indeed, this dollar strength stemming from rising inflation-adjusted yields could also prove self-regulating. An advancing greenback tends to weigh on commodity prices, and the jump in West Texas Intermediate prices has been the key driver of the advance in breakeven inflation rates.