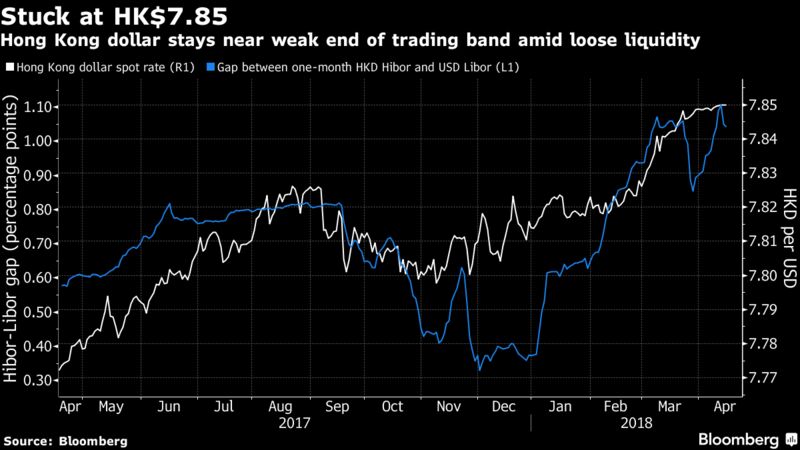

The Hong Kong dollar remains stuck at the weak end of its currency band, even after the monetary authority plowed $1.2 billion into defending the peg.

The city’s dollar traded near HK$7.85 per greenback at 12:23 p.m. local time, the level that can spur buying by the de facto central bank. The Hong Kong Monetary Authority has spent HK$9.7 billion ($1.2 billion) mopping up local dollars since the weak end of the band was reached on Thursday for the first time since 2005. The pace of intervention shows outflows are bigger than people had thought, according to China Everbright Bank Co.

“The pace of HKMA’s buying is a bit faster than we expected,” said Ngan Kim Man, deputy head of treasury at China Everbright Bank’s Hong Kong branch. Outflows are likely to accelerate as the U.S. further tightens monetary policy, which will finally boost short-end rates in Hong Kong, Ngan said.

Hong Kong interbank rates have lagged behind their U.S. counterparts thanks to an abundance of liquidity — something HKMA tightening may change. The aggregate balance of the city’s interbank cash supply will fall to HK$170 billion on Tuesday from the pre-intervention level of about HK$180 billion, according to the de facto central bank. One-month Hibor, as the local rate is known, stands at 0.85 percent, about 1 percentage point less than similar maturity Libor.

Hong Kong residents “shouldn’t expect that the environment of super low interest rates will persist forever,” Paul Chan, the city’s financial secretary, wrote in a blog Sunday. Investors “have to consider the possibility of a rise in the borrowing costs, and the impacts of higher interest rates on asset prices and their investments.”

The government has the capability of dealing with large capital outflows, and investors shouldn’t be too worried, Chan added. But still, analysts are flagging risks to the city’s home prices, which are among the least affordable in the world.

You may also like

-

Xiaomi Makes Its Trading Debut on the Defensive

-

U.S. Pulls Trigger on China Tariffs, Sparking Vow of Retaliation

-

China Vows Not to Fire Tariff Shot Ahead of U.S. in Trade War

-

Najib Pleads Not Guilty to Corruption Charges in 1MDB Case By

-

China Think Tank Warns of Potential ‘Financial Panic’ in Leaked Note