Dollar bulls may be a vanishing breed, but they’re far from extinct.

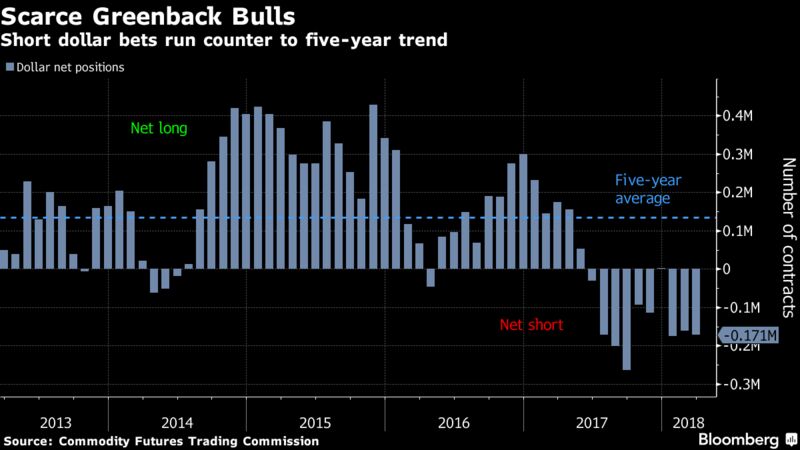

With the greenback extending last year’s slide into 2018, markets are broadly positioned for more weakness. That bias is seen in speculators’ positioning in the futures market and in the money flowing into U.S. exchange-traded funds that invest in foreign stocks and don’t hedge out currency swings.

But dollar bulls such as Sinead Colton are holding their ground, and should they prove right, the bears would face a painful squeeze. Colton, a global investment strategist at BNY Mellon Asset Management North America, expects the dollar to rebound against currencies such as the euro as the U.S. tax overhaul leads the American economy to outshine the euro region.“What currencies tend to respond to is the rate of change in economic growth,” said Colton, whose firm oversees $572 billion. “So yes, the euro zone is expanding, but that pace of positive surprise has declined. And actually the U.S, given the tax-reform package, is starting to outpace it.”

The Bloomberg dollar index sank 8.5 percent last year amid vibrant growth abroad and the prospect that other central banks would join the Federal Reserve in tightening policy. It’s down 2.3 percent in 2018, partly on concern over U.S. budget and current account deficits.

Euro Bear

However, Colton expects euro weakness to take hold in the next three to six months as growth dynamics in Europe and the U.S. shift. Euro-area gross domestic product will probably expand 2.3 percent in 2018, compared with 2.8 percent for the U.S., according to forecasts in Bloomberg surveys.The euro is her largest short position, while the dollar is the biggest bullish wager.That’s in contrast to the consensus of analysts surveyed by Bloomberg, which predicts the euro will climb to $1.26 by the end of 2018, from about $1.23 on Tuesday in New York. Being bearish the dollar is the second-most-crowded trade across financial markets, after long bets on certain technology companies, according to a March fund manager survey from Bank of America Merrill Lynch Global Research.Colton has company in calling for a dollar comeback.The currency is set for a boost because the Fed is probably going to signal a more aggressive path of rate hikes this week, according to Niall Coffey, chief investment officer of Avoca Global Advisors LLC.

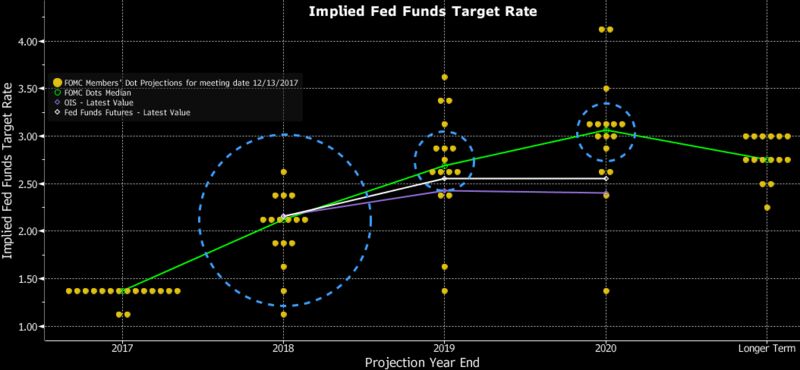

Policy makers’ latest quarterly forecasts will probably indicate a greater likelihood of 100 basis points of tightening in both 2018 and 2019, according to a March 14 research note from Coffey, formerly the chief foreign-exchange dealer at the New York Fed. In December, officials projected three quarter-point hikes this year, followed by about two in 2019.

“The U.S. dollar is likely to find support as the FOMC outlines a persistent policy tightening agenda,” Coffey wrote.

Source:BLOOMBERG

You may also like

-

Xiaomi Makes Its Trading Debut on the Defensive

-

U.S. Pulls Trigger on China Tariffs, Sparking Vow of Retaliation

-

China Vows Not to Fire Tariff Shot Ahead of U.S. in Trade War

-

Najib Pleads Not Guilty to Corruption Charges in 1MDB Case By

-

China Think Tank Warns of Potential ‘Financial Panic’ in Leaked Note