Hong Kong is considering imposing a tax on unsold apartments in its search for ways to cool the city’s red-hot housing market, a move that could unlock the supply of empty homes being hoarded by developers.

Financial Secretary Paul Chan said on an online talk show on Thursday that the number of unsold units had increased significantly so far this year, from the 9,500 vacant new homes at the end of 2017, without providing the latest number. He said that the tax would probably need to “have a particular target, and not apply across the board.”

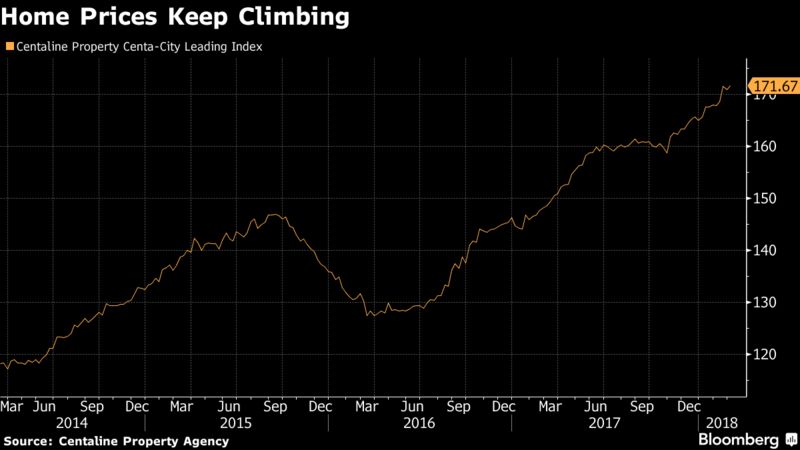

Hong Kong, home to the world’s least affordable market, has seen residential prices more than double in the past decade as constrained supply has failed to keep up with soaring demand. That has been exacerbated by a practice favored by developers, who sell new units in batches and routinely increase home prices during later releases.

For example, Sun Hung Kai Properties has only released for sale 436 out of 1,188 units at its Cullinan West Phase 2 project in Hong Kong’s West Kowloon area, said Bloomberg Intelligence property analyst Patrick Wong. Wheelock & Co. has only put about half the available units on the market at its luxury Mount Nicholson project. On Thursday, Wheelock announced that it sold a single home by tender for HK$1.4 billion ($179 million), setting an Asian record for the price per square foot at the development.

Under Criticism

Chan’s comments came as Hong Kong’s leaders have come under criticism for failing to cool runaway home prices in Hong Kong. Chief Executive Carrie Lam, who took office in July, has said that meeting the public’s housing needs remains the “top priority” for the government, although conceded in December that measures to cool prices haven’t worked.

If Hong Kong were to impose a tax on unsold apartments, it would replicate a system in Singapore, which imposes penalties on developers who hoard properties. Other global cities have taken a different approach to taming property booms, particularly targeting foreign buyers who leave homes unoccupied for months or years. Vancouver taxes owners of vacant apartments and the Australian state of Victoria, which includes Melbourne, imposed additional taxes on properties deemed to be empty for six months or more.Hong Kong’s Chan “seems to be more focused on developers keeping unsold units,” said Wong, unlike measures introduced in Melbourne and Vancouver.

Source:BLOOMBERG

You may also like

-

Xiaomi Makes Its Trading Debut on the Defensive

-

U.S. Pulls Trigger on China Tariffs, Sparking Vow of Retaliation

-

China Vows Not to Fire Tariff Shot Ahead of U.S. in Trade War

-

Najib Pleads Not Guilty to Corruption Charges in 1MDB Case By

-

China Think Tank Warns of Potential ‘Financial Panic’ in Leaked Note